Estate Planning Strategies in a Low-Interest-Rate Environment

The federal government requires the use of certain interest rates (published by the IRS) to value various items used in estate planning, such as an income, annuity, or remainder interest in a trust. The government also has interest rates that a taxpayer may be deemed to use in connection with certain installment sales or intra-family loans. These rates are currently at or near historic lows, presenting several estate planning opportunities. Low interest rates generally favor certain estate planning strategies over others and may have a detrimental effect on others.

Grantor Retained Annuity Trust (GRAT)

In a GRAT, you transfer property to a trust, but retain a right to annuity payments for a term of years. After the trust term ends, the remaining trust property passes to your beneficiaries, such as family members. The value of the gift of a remainder interest is discounted for gift tax purposes to reflect that it will be received in the future. Also, if you survive the trust term, the trust property is not included in your gross estate for estate tax purposes. If the rate of appreciation is greater than the IRS interest rate, a higher value of trust assets escapes gift and estate taxation. Consequently, the lower the IRS interest rate, the more effective this technique generally is.

Charitable Lead Annuity Trust (CLAT)

In a CLAT, you transfer property to a trust, giving a charity the right to annuity payments for a term of years. After the trust term ends, the remaining trust property passes to your beneficiaries, such as family members. This trust is similar to a GRAT, except that you get a gift tax charitable deduction. Also, if the CLAT is structured so you are taxed on trust income, you receive an upfront income tax charitable deduction for the gift of the annuity interest. Generally, the lower the IRS interest rate, the more effective this technique is.

Installment Sale

You may also wish to consider an installment sale to family members. With an installment sale, you can

More to Consider

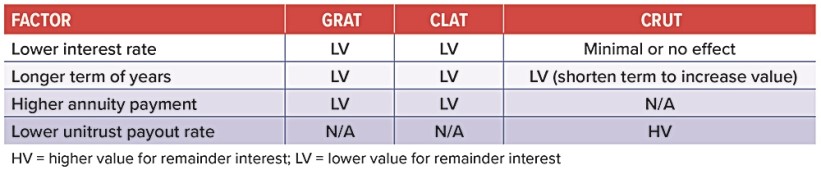

Here is how certain factors affect the valuation of remainder interest transfers in the trusts discussed here. In addition to the interest rate, you may want to consider how the length of the trust term and the amount of the trust payments affect values.

Generally defer the taxation of any gain on the property sold until the installment payments are received. However, if the family member resells the property within two years of your installment sale, any deferred gain will generally be accelerated. The two-year limit does not apply to stocks that are sold on an established securities market.

You are generally required to charge an adequate interest rate in return for the opportunity to pay in installments, or interest will be deemed to be charged for income tax and gift tax purposes. However, with the current low interest rates, your family members can pay for the property in installments, while paying only a minimal interest cost for the benefit of doing so.

Low-Interest Loan

A low-interest loan to family members might also be useful. You are generally required to charge an adequate interest rate on the loan to avoid income tax and gift tax consequences. However, with the current low interest rates, you can provide loans — or refinance an existing loan — at a very low rate and family members can effectively keep any earnings in excess of the interest they are required to pay you.

Charitable Remainder Unitrust (CRUT)

You retain a stream of payments for a number of years (or for life), after which the remainder passes to charity. You receive a current charitable deduction for the gift of the remainder interest. Interest rates have no effect if payments are made annually at the beginning of each year. Otherwise, interest rates generally have only a minimal effect. However, in this case, a lower interest rate increases the value of the charitable remainder interest slightly less than a higher interest rate would.

The use of trusts involves a complex web of tax rules and regulations, and usually involves upfront costs and ongoing administrative fees. You should consider the counsel of an experienced estate professional before implementing a trust strategy.

Content provided by Forefield for use by Eliot M. Weissberg, CFP®, CFS, of Raymond James Financial Services, Inc., Member FINRA/SIPC. The Investors Center, Inc. is an independent company. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from various sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Eliot Weissberg and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Past performances may not be indicative of future results. You should discuss any tax or legal matters with the appropriate professional.