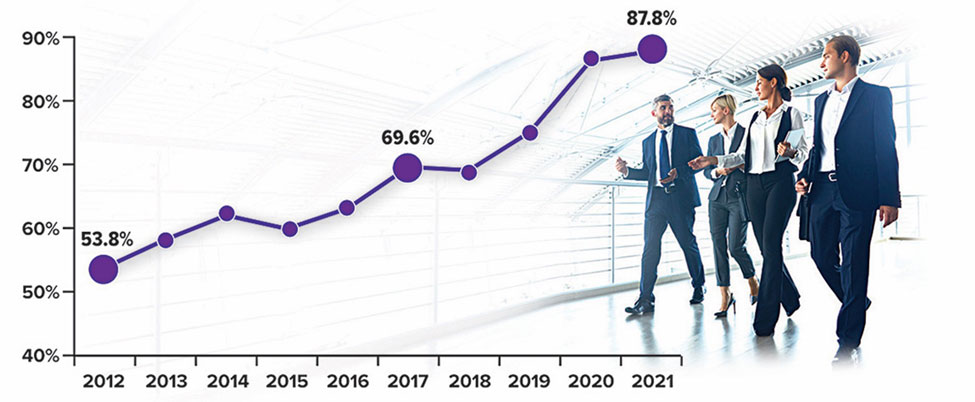

Employee Access to Roth 401(k) Plans on the Rise

Roth 401(k) plans can offer an ideal opportunity to build a source of tax-free retirement income. There are no income restrictions to participate, they have much higher contribution limits than Roth IRAs, and they may offer employer matching contributions. And thanks to the SECURE 2.0 Act of 2022, beginning in 2024, Roth 401(k)s will no longer impose required minimum distributions in retirement. The percentage of employers offering a Roth 401(k) plan grew substantially from 2012 to 2021, a trend that may continue.

Qualified withdrawals from Roth 401(k)s are free of federal income taxes if the account is held for at least five years and the account holder reaches age 59½, becomes disabled, or dies. State income taxes may apply. Nonqualified withdrawals are subject to regular income taxes and a 10% penalty.

Source: Plan Sponsor Council of America, 2022

Content provided by Forefield/Broadbridge for use by Eliot M. Weissberg, CFP®, CFS, of Raymond James Financial Services, Inc., Member FINRA/SIPC. The Investors Center, Inc. is an independent company. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from various sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Eliot Weissberg and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Past performances may not be indicative of future results. You should discuss any tax or legal matters with the appropriate professional.

M23260579 through 08/07/2024