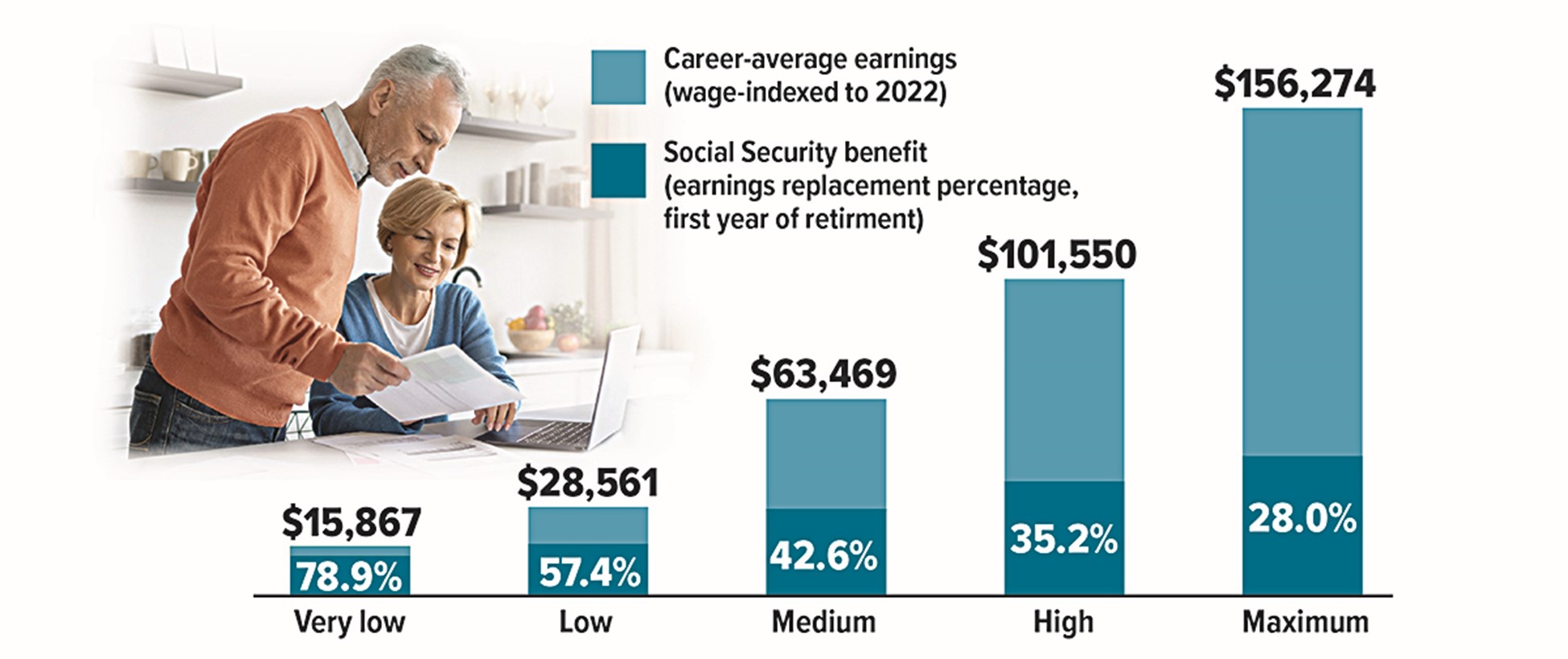

How Much Income Does Social Security Replace?

Social Security can play an important role in funding retirement, but it was never intended to be the only source of retirement income. The Social Security benefit formula is based on a worker's 35 highest-earning years (indexed for inflation), and the percentage of pre-retirement income replaced by the benefit is lower for those with higher earnings, reflecting the assumption that higher earners can fund retirement from other sources.

Here are replacement rates — based on five levels of earnings — for someone who claims benefits at full retirement age (FRA) in 2024 (i.e., born in 1958 and claiming at age 66 and 8 months). Rates would be similar for those who claim at FRA in other years.

Source: Social Security Administration, 2023 (Rates are based on scheduled benefits under current law and may be significantly lower in the future if Congress does not address the Social Security shortfall.)

Content provided by Forefield/Broadbridge for use by Eliot M. Weissberg, CFP®, CFS, of Raymond James Financial Services, Inc., Member FINRA/SIPC. The Investors Center, Inc. is an independent company. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from various sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Eliot Weissberg and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Past performances may not be indicative of future results. You should discuss any tax or legal matters with the appropriate professional.

M23-328263through 11/02/2024