Understanding Life Insurance

Your most valuable asset may be your ability to earn an income. Over the course of your lifetime, you could earn several million dollars — money that helps support you and your family. If something happened to you, how would your family replace your lost income? Life insurance can help replace your income when needed at your death. However, with the wide variety of policies available, it's important that you understand some of the basic types of life insurance coverage.

Term Life Insurance

With a term policy, you get "pure" life insurance coverage. Term insurance provides a death benefit for a specific period of time. If you die during the coverage period, your beneficiary (the person you named to collect the insurance proceeds) receives the death benefit (the face amount of the policy). If you live past the term period, your coverage ends, and you may get nothing back. Term insurance is available for periods ranging from one year to 30 years or more. You may be able to renew the policy for a new term without regard to your health, but at a higher premium. As you get older, the chance that you will die increases. For this reason, premiums generally increase as you get older. However, some term life insurance can be purchased for a fixed amount of death benefit, at a level premium, for a specified number of years. Most term insurance also has a conversion feature that allows you to switch your coverage to some type of permanent insurance without answering health questions.

Whole Life Insurance

Whole life insurance is a type of permanent insurance or cash value insurance. Unlike term insurance, which provides coverage for a particular period of time, permanent insurance provides coverage for your entire life, as long as you pay the premiums. When you make premium payments, you pay more than is needed to pay for the current costs of insurance coverage and expenses. The excess payment is credited to a cash value account. This cash value account allows the insurance company to charge a level premium and to provide a death benefit and cash value throughout the life of the policy. The cash value grows tax deferred and can be directly accessed through a partial or complete surrender of the policy, or through policy loans. It is important to note, however, that a policy loan or partial surrender will reduce the policy's death benefit, and a complete surrender will terminate coverage altogether.

Universal Life Insurance

Universal life is another type of permanent life insurance with a death benefit and a cash value account. Unlike traditional whole life, universal life insurance allows you flexibility in making premium payments. Universal life insurance policy premiums may be adjusted upward or downward within policy guidelines. Reducing or increasing premiums will impact the growth of the cash value component and possibly the death benefit. Some universal life policies also allow you to choose a level or increasing death benefit. Be aware, though, that if you want to raise the amount of coverage, you'll need to go through the insurability process again, probably including a new medical exam, and your premiums will increase.

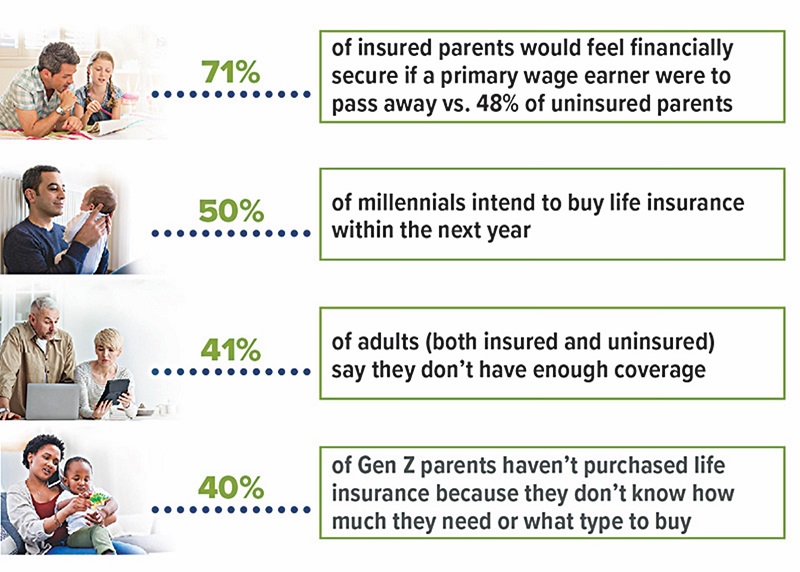

Strong Interest in Life Insurance

Source: 2023 Insurance Barometer Study, Life Happens and LIMRA

The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. There are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. Any guarantees are subject to the financial strength and claims-paying ability of the insurance issuer. Loans and withdrawals will reduce the policy's cash value and death benefit, could increase the chance that the policy will lapse, and might result in a tax liability if the policy terminates before the death of the insured. Additional out-of-pocket payments may be needed if actual dividends or investment returns decrease, if you withdraw policy cash values, if you take out a loan, or if current charges increase.

Content provided by Forefield/Broadbridge for use by Eliot M. Weissberg, CFP®, CFS, of Raymond James Financial Services, Inc., Member FINRA/SIPC. The Investors Center, Inc. is an independent company. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from various sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Eliot Weissberg and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Past performances may not be indicative of future results. You should discuss any tax or legal matters with the appropriate professional.

M23-328263through 11/02/2024