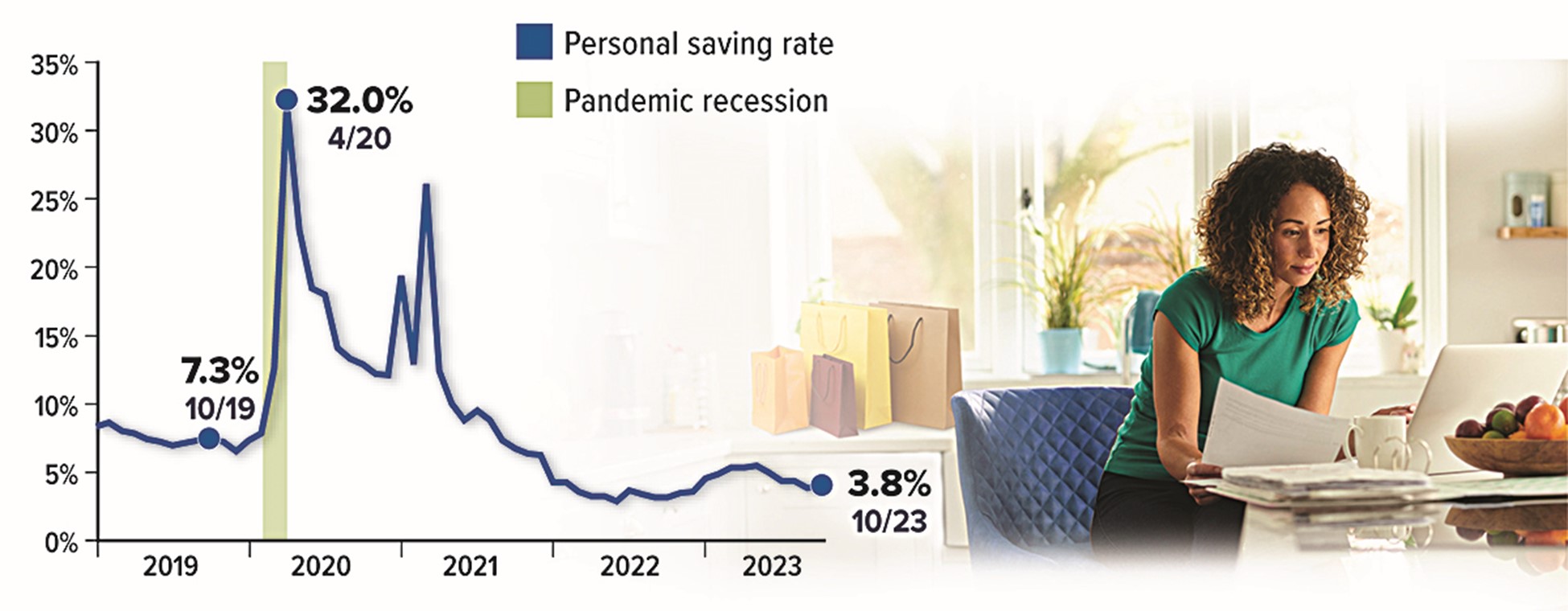

Saving Less? You're Not Alone

The U.S. personal saving rate — the percentage of personal income that remains after taxes and spending — was 3.8% in October 2023. The saving rate spiked to an all-time high during the pandemic, when consumers received government stimulus money with little opportunity to spend but fell quickly as stimulus payments ended and high inflation ate into disposable income. The current level is well below pre-pandemic saving rates.

A low personal saving rate means there is less money available on a monthly basis for saving and investment. However, many households still have pandemic-era savings, and the low rate indicates consumers are willing to spend, which is good for the economy. The question is how long this spending can be sustained.

Sources: U.S. Bureau of Economic Analysis, 2023; Bloomberg, October 10, 2023

Content provided by Forefield/Broadbridge for use by Eliot M. Weissberg, CFP®, CFS, of Raymond James Financial Services, Inc., Member FINRA/SIPC. The Investors Center, Inc. is an independent company. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from various sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Eliot Weissberg and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Past performances may not be indicative of future results. You should discuss any tax or legal matters with the appropriate professional. M24-381867 through 1/09/2025.